Shock to the System: Double Interconnector Loss

(This article is written by Jon Sedgwick, Eoin Sweeney and Ayodele Bickersteth from VIOTAS)

On 14th May 2024, the all-island electricity grid saw an unexpected shutdown of its two interconnectors, almost simultaneously in the early hours of the morning. This article provides some VIOTAS insights into what happened.

Background – Interconnectors

Ireland currently has two operational HVDC interconnectors: the Moyle Interconnector, a 500 MW link between Northern Ireland and Scotland, and the East West Interconnector (EWIC), a 500 MW link between Ireland and Wales. Two further HVDC interconnectors are currently in construction: the Greenlink Interconnector, a second 500 MW link between Ireland and Wales expected to be operational in late 2024, and the Celtic interconnector, a 700 MW link between Ireland and France expected to be operational in 2026/27.

This means that the all-island Single Electricity Market (SEM) currently has the capability to import/export up to 1 GW to/from Great Britain (GB), but that by the end of the decade it will have the capability to import/export in excess of 2 GW, with interconnection to both GB and continental Europe.

As the energy transition continues to accelerate, interconnectors play an important role in Ireland’s strategy to deliver 80% renewable electricity generation by 2030 and to become a large net exporter of renewable energy during periods of surplus.

Double Interconnector Loss – 14th May

In the early hours of Tuesday 14th May 2024 there was an unplanned loss of both the EWIC and Moyle interconnectors, from importing in excess of 90% of their maximum capacity. The interconnectors had been importing more than 900 MW since approximately 8pm the previous evening, meeting approximately 25% of all-island demand at the time the event occurred, just after 1am, and levels of wind generation were low, at approximately 600 MW.

After the event, the Moyle interconnector was back to importing in excess of 400 MW within 3 hours, however the EWIC interconnector remained offline until approximately 7pm that evening.

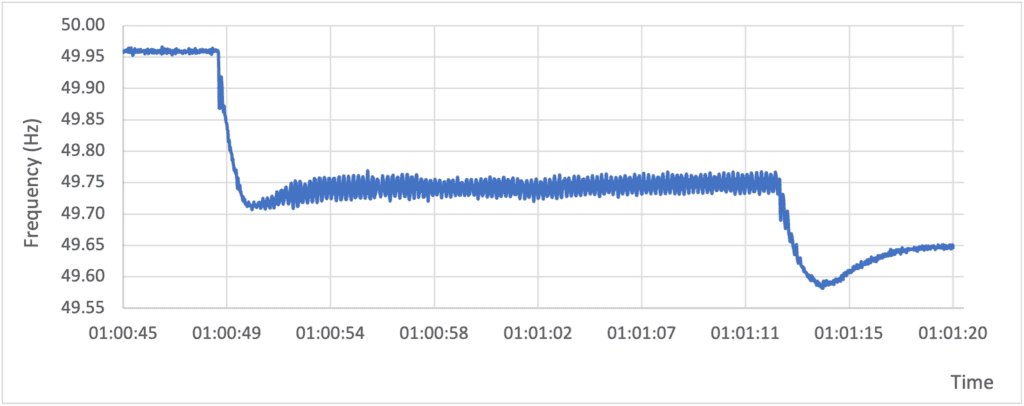

VIOTAS does not have sight of all of the contributing factors which transpired or caused a related trip on both interconnectors within a very short period of time. However, it is testament both to the expertise of the EirGrid / SONI Control Centre staff and also the service delivery of all of the providers of fast response reserve services that the sudden loss of more than 900 MW (more than 25% of system demand at the time) only led to the grid system frequency falling to approximately 49.6 Hz, and that it was restored to 50 Hz within approximately 20 minutes. Many other power systems worldwide would never see such a large loss relative to the system size.

Interesting Thought Avenues

Volume requirements

The events of 14th May raise interesting questions around the optimal volume requirements of reserve services which the Transmission System Operators (TSOs) should procure. The TSOs are currently required to maintain a minimum operating reserve equal to 75% of the Largest Single Infeed for the POR and SOR timeframes (up to 90 seconds following a frequency disturbance), and 100% of the Largest Single Infeed for the TOR1 and TOR2 timeframes (out to 20 minutes following a frequency event)[1].

Dimensioning the required volumes of reserves as up to 100% of the Largest Single Infeed risks leaving the power system in a precarious position in case of a simultaneous / near-simultaneous loss of multiple generation plants with combined capacity in excess of the Largest Single Infeed. As we saw on 14th May, there remains a credible risk of such a connected loss of multiple large infeeds. While procuring reserve volumes in excess of 100% of the Largest Single Infeed would increase the cost of running the system, it may be necessary to ensure the grid has sufficient capability to deal with low probability / high impact events such as that seen on 14th May, without leading to load shedding.

Similar events which led to connected trips on multiple generating units have been seen in other markets. For example in August 2019 Great Britain’s power system saw a lightning strike ultimately lead to the cumulative loss of in excess of 1,100 MW of generation across multiple plants[2].

The TSOs’ analysis presented in the recently published DS3 System Services Tariff Consultation[3] shows contracted volumes for the reserve services which materially exceed the minimum volumes set out above, and describes how the fast deployment of large volumes of particularly battery storage technologies have caused oversupply of these services. Despite this outlook, it’s highly likely that the TSOs were grateful for the provision of these surplus / oversupply volumes on the 14th May with the very large amount of capacity which was lost so suddenly from the system, and that this played a key role in limiting the frequency nadir and the system’s ability to quickly recover.

As the power system continues to transition away from conventional generation technologies which delivered material system security / stability benefits as a by-product of energy generation, to one dominated by Inverter Based Resources, it may be that the TSOs require additional volumes of reserve services to maintain system security.

The ancillary services volume requirements and Volume Forecasting Methodology will be the focus of a dedicated consultation during 2024 as part of the development of the System Services Future Arrangements. In addition to the projected increase of the Largest Single Infeed to 700 MW from 2026 when the Celtic interconnector becomes operational, there may be merit in the volume requirements for ancillary services being based on a credible risk scenario greater than the loss of the Largest Single Infeed. The system event of 14th May has confirmed that there are credible contingency events which significantly exceed the N-1 loss of the Largest Single Infeed.

Requirement for upwards and downwards reserve services?

While on this occasion the interconnectors were the Largest Single Infeed and tripped while importing, there is also the potential for an interconnector trip while exporting as the Largest Single Outfeed. This is currently managed by staggering the over-frequency protection settings on wind farms to quickly reduce generation in case of a detected over-frequency event. As interconnector flows increase, both importing and exporting, the credible scenario remains of a large interconnector trip while exporting, with the potential to cause a sudden increase in system frequency. With the delivery of the Greenlink and Celtic interconnectors in the coming years, and the resulting increase in the size of the Largest Single Outfeed to 700 MW, it may be preferable to explicitly procure – and value – the downward reserve service effectively currently provided by wind farms. This could see the introduction of bidirectional reserve services, as is already the case in other markets such as the Australian National Electricity Market which procures both raise and lower services within its Frequency Control Ancillary Services (FCAS) markets.

The current DS3 Regulated Arrangements only include raise style services which provide upwards reserve. As the energy transition continues, the explicit definition and market-based procurement of lower style services which provide downwards reserve to restore the frequency quickly in case of an outfeed trip are likely to be required.

The potential procurement of both upwards and downwards reserve services is expected to be included as part of the ancillary services Product Review which is already planned during 2024 as part of the development of the System Services Future Arrangements.

Interconnector adequacy contribution?

Interconnection enables the SEM to export power during periods of surplus renewable generation, as well as to depend on power imports when required. While it was not a contributing factor to the issues which transpired on 14th May, the increasing capacity of interconnection also raises questions as to the extent to which interconnectors can be relied upon to import during periods where system conditions are tight.

Coincident scarcity in connected markets can limit the ability to rely on power imports, and the Capacity Remuneration Mechanism (CRM) design process recognised from the outset that the direction of interconnector flows (which depend on relative market prices) has a very significant impact on system security.

However, the current market design enables interconnectors to directly participate in the CRM, competing with other capacity providers while not being exposed to Difference Charges in the same way. It is important to highlight that, depending on how they are scheduled in the market (to import / export) interconnectors have the potential to not only underdeliver, but to negatively deliver if exporting at a time of scarcity.

This risk of coincident scarcity in connected markets is managed by using “External Market Derating Factors” (EMDF) to reflect each interconnector’s expected adequacy contribution. However, the current value of the EMDF applied for GB interconnectors was set in April 2017 and has not been changed since, despite obviously different market conditions, including post Brexit changes to the SEM-GB market coupling arrangements which determine interconnector flows, material generation mix changes in both markets, and the interconnection of GB to Norway (2021) and Belgium (2019). We now also have operational data from a number of scarcity events since the commencement of the I-SEM market arrangements, and it would be prudent to review interconnector derating factors to ensure capacity allocations reflect their actual expected system adequacy contribution.

Summary

As additional interconnectors are built, Ireland’s capacity to import/export electricity from its neighbours will significantly increase. As Ireland builds out large volumes of renewable generation capacity (5 GW offshore wind, 9 GW onshore wind, and 8 GW solar capacity by 2030) to deliver its Climate Action Plan targets, power flows across these sizeable interconnectors are likely to be very large at times of both high or low renewable generation. Interconnectors will likely remain the largest single infeed / outfeed for the all-island power system, and they will therefore play an important role in dictating the volume and type of reserve services which the system requires in order to deal with the credible risk scenarios from unexpected trips.

When the Celtic interconnector goes operational, the all-island power system will have 2.2 GW of interconnection capacity on power system with a peak demand which is projected to be approximately 8 GW [4]. This degree of interconnection capacity represents a significant portion of all-island peak demand and will play a progressively important role in the dynamics of the market.

While the event on 14th May showcased the world leading nature of the Irish power system, there are several market design considerations which must be reviewed as Ireland continues to increase its interconnection with other markets, in order to continue to maintain system security while accommodating increasing levels of renewable generation.

[1] POR = Primary Operating Reserve, SOR = Secondary Operating Reserve, TOR1 = Tertiary Operating Reserve 1, TOR2 = Tertiary Operating Reserve 2

[2] National Grid ESO LFDD 09/08/2019 Incident Report (ofgem.gov.uk)

[3] DS3-System-Services-Tariffs-Consultation-27-March-2024.pdf (eirgrid.ie)